On Data

& Stats

Krisna Gupta

Krisna Gupta who? 👀

-

Associate researcher di CIPS.

-

Economics PhD Student di Australian National University.

-

Double degree Master in Econ dari UI / VU Amsterdam..

-

Research on trade & industry in Indonesia.

-

Blogs & sing in spare time. L’arc~en~Ciel fan.

Some publications 😎

-

Krisna Gupta (2020). Industri 4.0 sebagai solusi daya saing industri indonesia?. In Denny Irawan, Wasisto Raharjo Jati, Oscar Karnalim, Asrul Sidiq (Eds), Mewujudkan Indonesia 4.0: Kumpulan Pemikiran Pelajar Indonesia di Australia. Jakarta: Yayasan Pustaka Obor Indonesia.

-

Arianto Patunru, Krisna Gupta (2020). Indonesia's PPE export ban backfires. East Asia Forum.

About today

- Some intro

- Various ways data is presented

- Some stats

- Economic data

- Q&A

I assume y’all have never worked with data before

I try to allocate more for Q&A

Intro

Why?

-

Efficient & powerful to support your story.

- you don’t really need to be a math&stat-savy.

-

Shows how good you are in understanding an issue.

-

Objective, most of the time.

-

Everyone use ‘em these days. Tough luck for data haters.

Data is getting mainstream

Some of my fave data source

- For trade, UN Comtrade https://comtrade.un.org/data/.

- General economic data, World Bank’s World Development Indicators https://data.worldbank.org/.

- Bank Indonesia (just google “SEKI Bank Indonesia”).

- BPS (either hit https://www.bps.go.id/ or query your keyword in google + ‘BPS’).

- ask them researchers.

Some jargons

-

Cross-sectional data: contains a snapshot of many subjects/individuals (people, countries, firms, etc) in a given time.

-

Time-series data: one subject observed for a long(-ish) periods of time.

- Good if trend is important.

-

Panel data: combination of the two.

Various ways data is presented

Cartesian plane

Tables

-

Not the best visualization but very flexible. (ex)[https://comtrade.un.org/data/]

- easy to costumize with templates & other viz.

- can store many variables.

-

The most mainstream tools are microsoft excel & Google sheet.

- Hence It’s best to have a

.csvor.xlsxor something similar.

- Hence It’s best to have a

-

I certainly prefer working with these formats (among others)

Tables

- First row is usually shows variables.

- Note that a machine-readable tables are the best!

- i.e., it is better to have one row for variables.

- Example of bad machine-readability

Units in the X, Y and columns

-

Never lose sight of the units of your value.

- e.g., thousand or millions, kg or ton, etc.

-

Especially important if you use various data source.

- BI’s trade data is in 1000USD while Comtrade’s in USD.

-

Always read what’s X and Y.

- if you make the graph, always write what’s X and Y.

Some statistics

The need to aggregate

-

How to process an information of the income of 1 million people?

-

When we have data of 1 million people, it’s impractical to look at 1 million values.

-

We look for one number that represent these 1 million values.

- this is usually the average (or mean).

-

We also need to understand how the value is distributed.

- called standard deviation.

Normal distribution

-

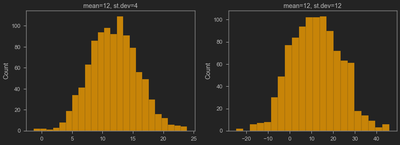

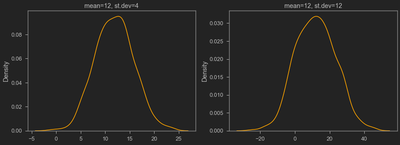

If we group values, take frequency, then sort them, we can make a distribution plot.

-

We can make a smooth approximation of the distribution plot with functions.

-

The most famous distribution is the normal distribution

-

Normal distribution’s characteristics:

- frequency is highest around the mean

- the tail is skinny (i.e., frequency is very small in the extremes)

Normal distribution

Normal distribution

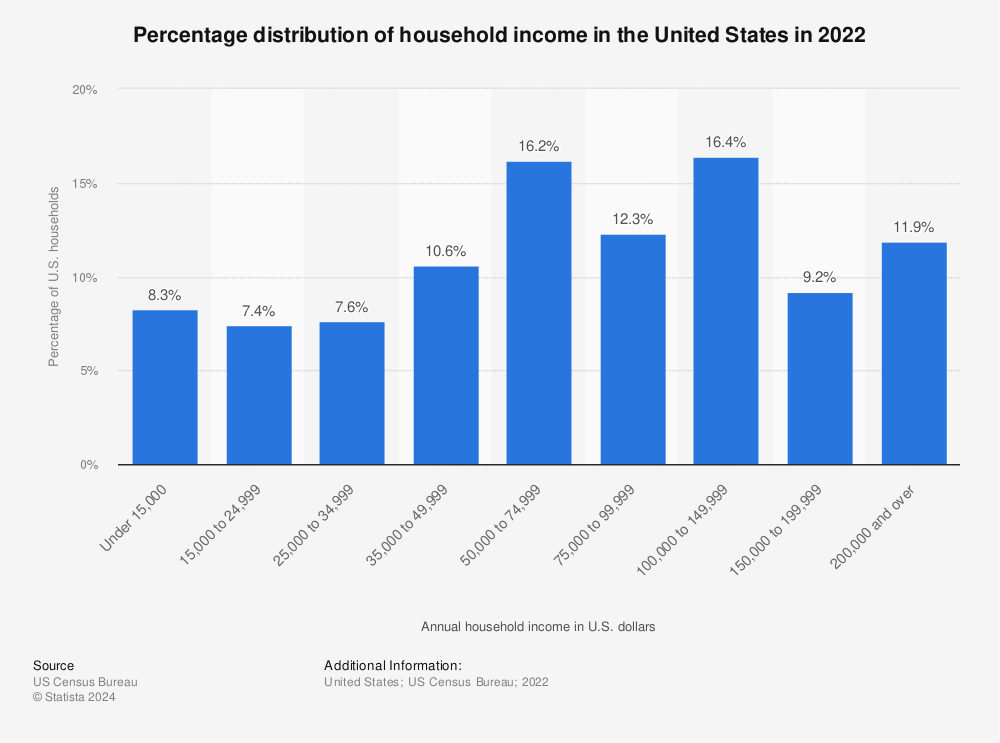

When to use median

-

Median is the value lying in the middle of the whole group if we sort the value.

-

If we have 1 million people:

- Sort their income from lowest to highest.

- Median is the income of the 500.000th person.

-

Median is often use in the presence of non-trivial number of extreme values (i.e., fat tail).

-

income is often not distributed normally, so median is better.

-

example in excel.

Find more statistics at Statista

Economic data

Real vs nominal

-

We use currency to express many economic variables.

-

We can’t aggregate car + food.

- we can 200 million + 50 thousand.

-

But really what we want is the car and the food, not the money.

-

We need to take into account change in prices (i.e., inflation)

Real vs nominal

-

Say a firm can make 1 car and 100 food in 2020.

-

The firm’s GDP is $1 \times 200 + 100 \times 0.05 = 205$

-

in 2021, car’s price is increase to 210, hence GDP becomes 215.

-

Increased GDP?

- not really, cuz the firm still just produced 1 car and 100 food.

Real vs nominal

-

It’s easy to imagine the complexity of this stuff in reality.

-

One thing is clear though: we want to exclude increase in GDP from price effect.

-

To avoid price effect, we use 2020 price so we can compare 2020 GDP with 2021 GDP.

-

Real GDP = When we use old prices.

Real vs nominal

-

Obviously to keep comparing, we still need to use 2020 prices when we calculate 2022 GDP.

-

also when we calculate GDP in 2023, etc.

-

Because we keep using 2020 prices, we say ‘constant price’.

- 2020 is called ‘reference year’.

- nominal GDP is calculate using ‘current price’.

- nominal GDP = constant real GDP in the reference year.

-

The constant price changes from time to time.

GDP vs GDP per capita

-

GDP is an aggregate of the whole economy.

- used to show how big & important the country is.

-

GDP per capita is the mean/average

- used to reflect living standard & productivity.

-

Singapore vs Indonesia: rich vs powerful.

Fraction

-

Fraction is usually expressed with percent.

-

We use fraction to express how important an individual is to the group/population.

-

India imports 3.05 billion USD of CPO from Indonesia doesn’t say a lot.

- India imports 61% of its CPO from Indonesia says how important supplier Indonesia is.

- From Malaysia ~32%, FYI.

Percent change / growth

-

Growth is important to reflect how fast something is changing.

-

Percent change is nice cuz it’s unit-free.

-

It linearizes non-linear thing, which’s good and bad.

-

If your income drop by 50% today, will 50% increase tomorrow get you back to your old income?

Index

-

Index is prolly the most confusing thing.

-

Index can be in many forms with many different weight.

- sometimes you might need to check its formula.

- the purpose of index is still to give us one representative number to reflect the big picture.

-

For example, consumer price index (CPI) calculates a change in price level of many consumer goods.

-

Indeks Kedalaman Kemiskinan shows how deep the poverty of some area is.

A note on CPI and similar indices

-

CPI and many other indicies are shown in number near 100.

-

That’s because CPI is calculated as compared to 100.

- 100 is the ‘base’, the year where CPI=100 is called reference year.

-

For example, if CPI in 2010=100 while 2020=154, that means prices in 2020 is 54% higher than 2010.