Ketidakseimbangan global dan implikasinya

2022-09-12

Profile

I Made Krisna Gupta (Imed)

UI,DEN,CIPS

PhD in Econ at Australian National University.

Focuses on international economics and industrial policy

more at krisna.or.id or @imedkrisna

Outline

GDP accounting and trade balance

Global Current Account Imbalance

Going forward

US-China rivalry

The failure of WTO boils down to the US-China (and Japan before it) dynamics.

We will learn why trade war started, and will fail to solve US deficit problem.

First, we will have to learn why capital account matters to trade issues.

Goals: to understand that trade war won’t end anytime soon, unless US and/or China fix their capital imbalance.

Miskonsepsi merkantilis

- Ingat persamaan PDB konsumsi:

Y=C+I+G+(X−M)

menekan M = menurunkan C, bukan menaikkan Y.

Saving S=Y−C−G, artinya S=I+(X−M)

Net ekspor (X−M>0) sama saja dengan S>I alias net capital outflow.

Current Account

X>M= current account surplus, X<M= current account deficit.

CA dunia selalu balance: surplus di 1 negara akan dibarengi dengan defisit di setidaknya 1 negara.

Negara yang defisit berarti membeli barang tanpa membayar → ngutang.

- Deficit CA → net investment position minus.

Negara yang surplus berarti memberi barang tanpa dibayar → piutang.

CA & Saving

di closed economy, S=Y−C−G=I

di open econ, S=I+X−M=I+CA

Di open economy, saving dapat dilakukan di dalam negeri DAN di luar negeri.

Demikian pula investment: kekurangan modal domestik? Manfaatkan foreign capital market!

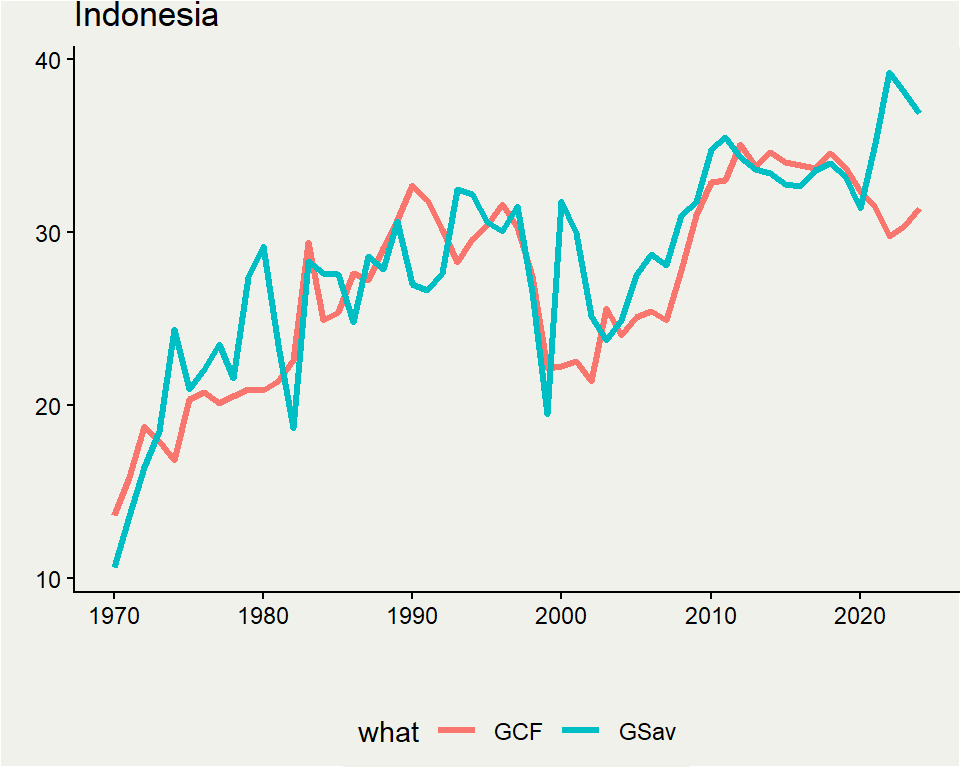

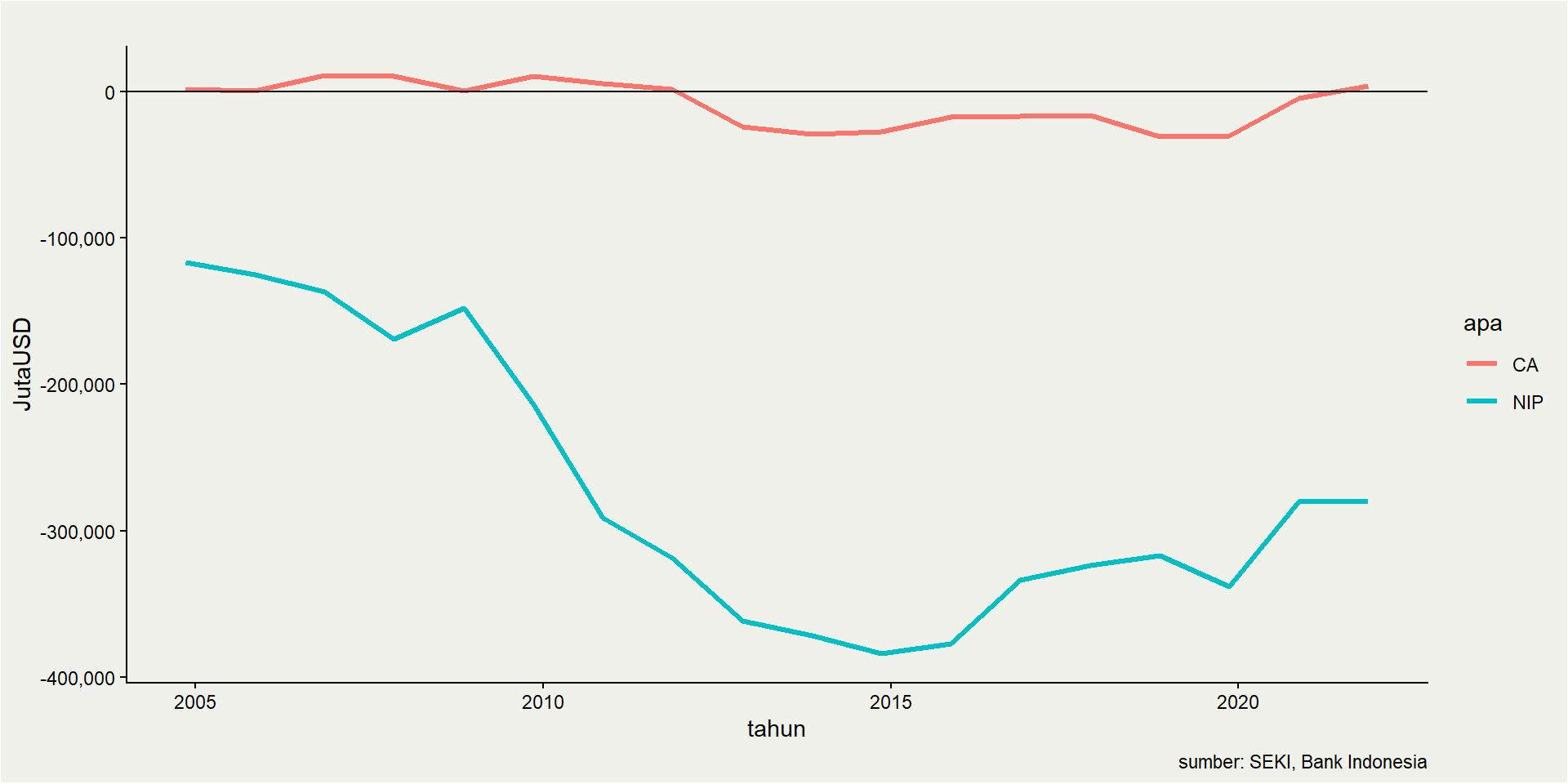

Indonesia’s CA & IIP

Saving-investment (% GDP)

Current account balance (CAB) is simply the difference between Domestic saving (GSav) and investment (Gross Capital Formation, GCF) in Indonesia.

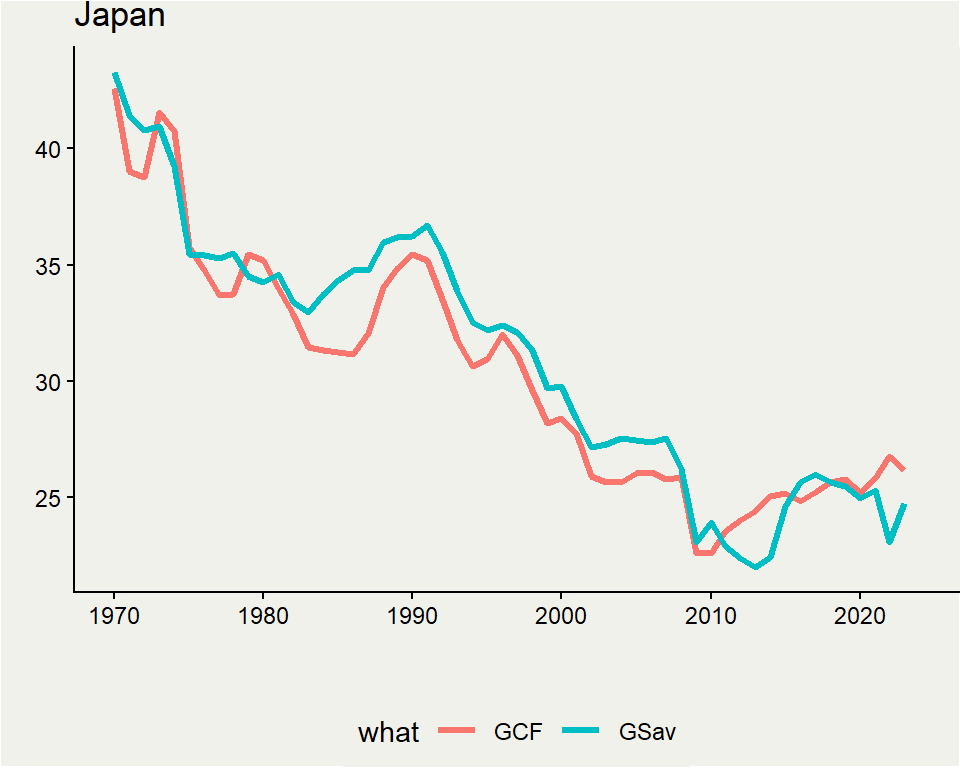

Meanwhile in Japan, saving rate keeps decreasing since 1970. However, Japan constantly see saving>investment (surplus CAB) with notable exceptions.

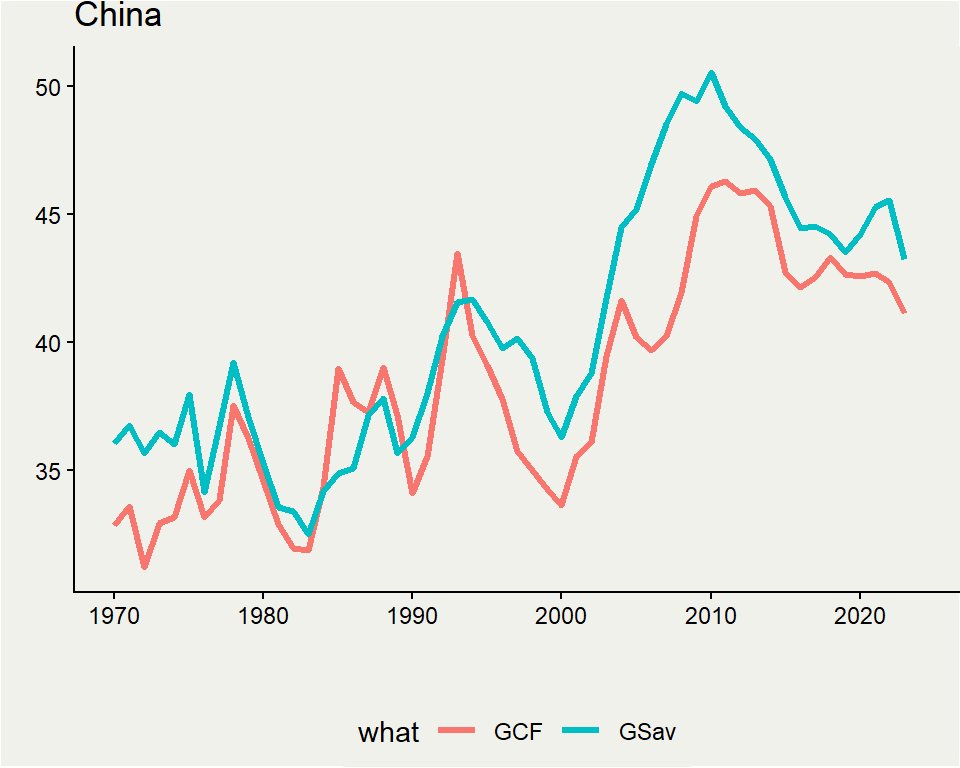

Saving-investment (% GDP)

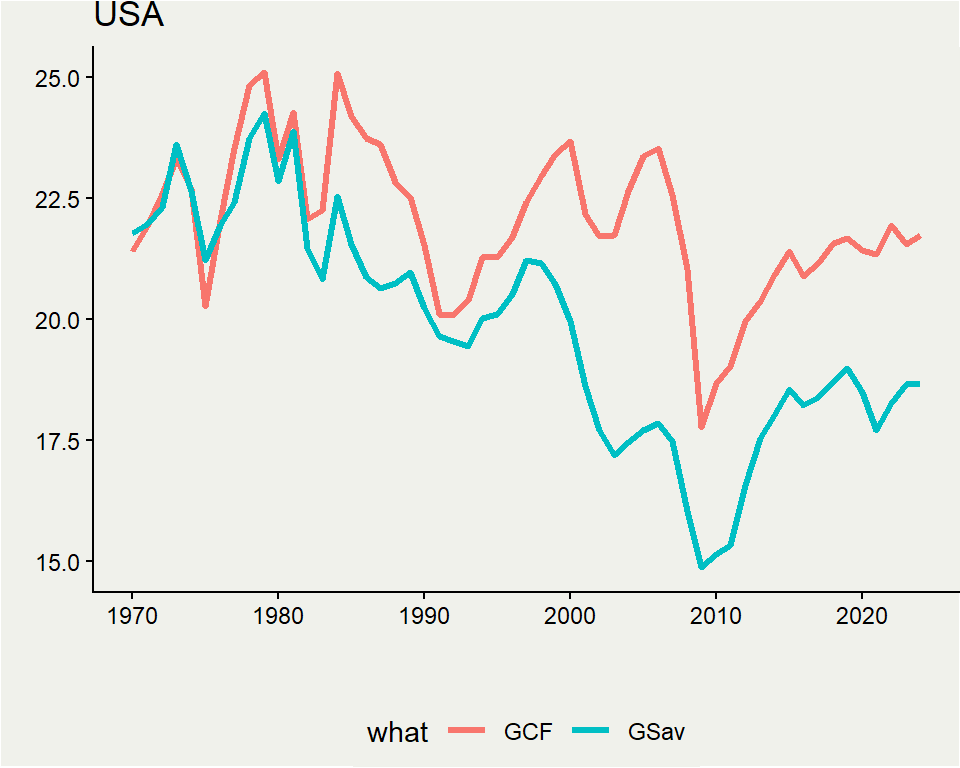

USA constantly has higher GCF compared to its saving rate. Meaning, US sees a constant CAD (current account deficit) which seems to be increasing in 2000s.

China, meanwhile, see a constant CA surplus with no notable decrease in saving rate (like Japan), but instead tend to go up (like Indonesia)

CAB

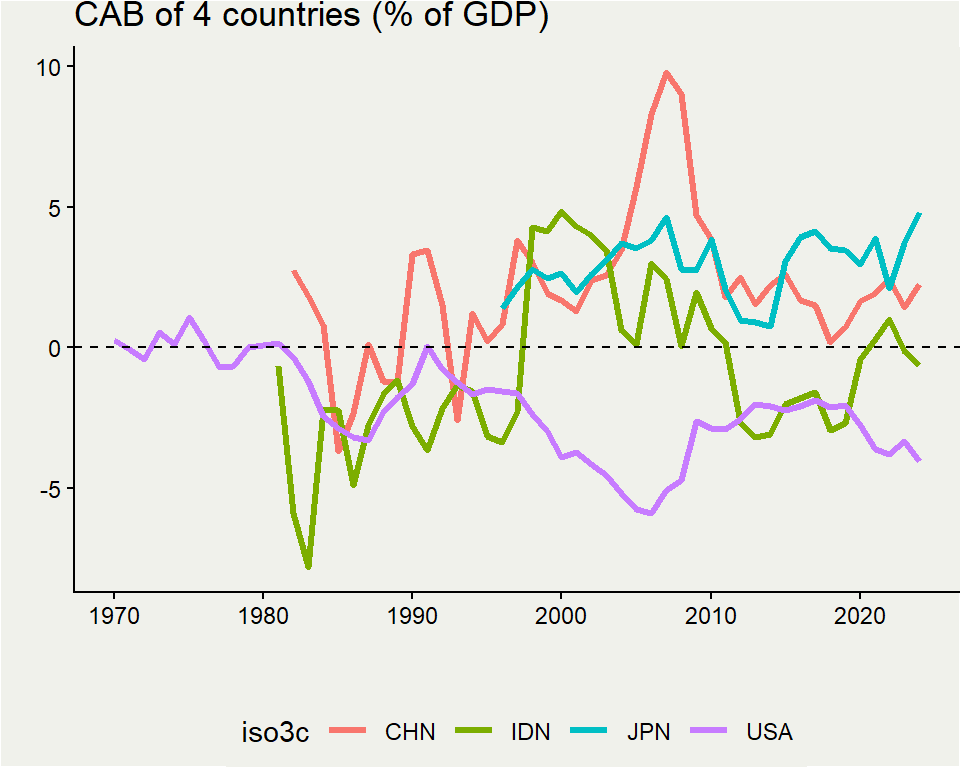

This graph shows current account balance of the 4 countries. Indonesia sees a surplus during the commodity boom, but overall moves around. China and Japan sees a constant surplus while the US a constant deficit. Japan and China = net creditors, USA = net debtor.

Current account driver

The core problem is the capital flow. Will remains to be as long as:

US don’t control their deficit

China kept buying US assets, one way or another

Some blame China amid Chinese activist domestic policies, while US simply accomodate Chinese surplus.

Some blame the US for uncontrolled deficit.

Implikasi

Current account surplus artinya ada arus modal keluar.

Selama China jadi net-saver, ekspor mereka akan tinggi. Jika tidak bisa masuk AS, harus masuk ke tempat lain.

- trade tension with China is going to increase everywhere.

US is still important as buyer of last resort.

- Kepercayaan pada USD assets tergantung AI dan Fed’s independence.

Implikasi

Diplomasi semakin diperlukan, karena menghadapi turbulensi ini diperlukan kerjasama ‘middle powers’ yang kuat.

BRICS most likely akan China driven: largest economy, best tech & knowhow, have reserves.

Vaccuum of leadership in ASEAN.

domestic reform semakin mendesak.

Competitiveness?

Makin sulit mengatakan bahwa ekspor suatu negara menandakan keunggulan kompetitif:

Negara yang secara konstan undervalue currency-nya akan otomatis tinggi ekspornya.

Negara yang mengurangi konsumsi domestik (melalui kebijakan supply-driven) akan tinggi ekspornya.

Ekspor ini diserap oleh negara dengan kebijakan demand-driven dan loose monetary supply (UK, Aus, USA).

Tidak berarti pemerintah harus berdiam diri, namun analisis trade & industri jadi harus lebih holistik.

Competitiveness?

Seiring Indonesia meningkatkan kebijakan demand-driven (subsidi konsumen, universal healthcare), wajar jika NX ↓.

Indonesia adalah investing country. CAD in short term adalah hal yang wajar (Gupta, Gretton & Patunru 2022).

- Konsumsi barang modal tinggi, tidak bisa disupply hanya dari produksi dalam negeri.

True impact of trade should be reflected from economic growth in general, not only NX!

- trade’s role is not to accumulate wealth, but to improve efficiency & living standards!

Monetary policy

Kebijakan moneter saat ini cukup loose, tapi mata uang tetap dijaga

Beberapa minggu terakhir, asing net sell. Domestic takes over?

- Export demand perlu dijaga, tapi domestic demand juga perlu didorong

To save or to consume?

- Domestic reform wajib dilakukan untuk mendorong efisiensi alokasi sumber daya